wyoming tax rate for corporations

No entity tax for corporations. Wyoming corporations still however have to pay the federal corporate income tax.

The current corporate tax rate federal is 21 thanks to the Tax Cuts and Jobs Act of 2017.

. If there have not been any rate changes then the most recently dated rate chart reflects the rates currently in effect. The annual report fee is based on assets located in Wyoming. This is typically at a rate of 153 percent.

You can find more information on. Even with added taxes within different counties or municipalities the tax rate is normally no higher than 6 percent. 51 rows 10 BEST states to form an LLC or corporation in 2021.

If you use Northwest Registered Agent as your Wyoming registered agent youll have an online account to track your company in receive notification reminders to file your annual reports on time annual tax reminders. Prior to the Tax Cuts and Jobs Act there were taxable income brackets. To qualify for the states refund program.

Tax rate charts are only updated as changes in rates occur. The corporation will pay taxes on all revenue earned from the US. Wyoming has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 2.

State Parks and Cultural. However Wyoming does have a 4 sales tax on various goods and services sold by Wyoming businesses. Average Sales Tax With Local.

In addition Local and optional taxes can be assessed if approved by a vote of the citizens. Theres good reason for that. Additionally counties may charge up to an additional 2 sales tax.

Explore data on wyomings income tax sales tax gas tax property tax and business taxes. Corporate Tax Rate Rank. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent.

See the publications section for more information. Wyoming has been consistently ranked as the most tax friendly state in the union. On profits of 100000 you would pay self-employment tax of 15300.

Articles of IncorporationContinuanceDomestication 5000. Annual Report License tax is 60 or two-tenths of one mill on the dollar 0002 whichever is greater based on the companys assets located and employed in the state of Wyoming. In Wyoming you will pay no.

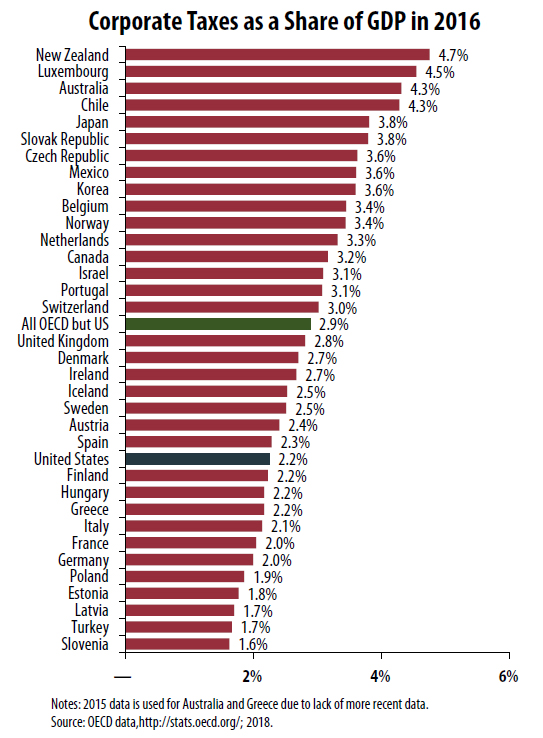

Though often thought of as a major tax type corporate income taxes accounted for an average of just 466 percent of state tax collections and 227 percent of state general revenue in fiscal year 2018. Some of the advantages to Wyomings tax laws include. If your business is responsible for collecting and remitting Wyoming sales tax you need to register with the Wyoming Department of Revenue.

Herschler Building 2nd Floor West. And overseas under US. Each states tax code is a multifaceted system with many moving parts and Wyoming is.

4 percent state sales tax one of the lowest in the United States. On profits of 20000 you would pay self-employment tax of 3060. B Minimum tax is 50 in Arizona 50 in North.

On profits of 60000 you would pay self-employment tax of 9180. Which means that in Wyoming you avoid the burden of double taxation. Nonprofit Corporations and Cooperative Marketing Associations.

Corporations are not charged an entity tax in Wyoming. You read that correctly. We include everything you need for the LLC.

Tax rates for both. Sales Use Tax Rate Charts. State wide sales tax is 4.

No corporate income tax. 10 -Wyoming Corporate Income Tax Brackets. Local areas may also impose additional sales taxes which can be added onto the overall state sales taxes.

The state of Wyoming charges a 4 sales tax. The state of Wyoming does not levy a personal or corporate income tax. If you are not resident in the US your Wyoming LLC will only pay tax on US-sourced income.

Tax Bracket gross taxable income Tax Rate 0. Unemployment Insurance Tax Rank. The corporate tax rate applies to your businesss taxable income which is your revenue minus expenses eg cost of goods sold.

A Wyoming LLC also has to file an annual report with the secretary of state. Personal rates which generally vary depending on the amount of income can range from 0 for small amounts of taxable income to around 9 or more in some states. No personal income taxes.

Low property tax percentages. 6 hours agoEllen Gerst. 180 rows Wyoming Sales Tax.

You will file Form 1120 as the business was incorporated in the United States. Wyomings tax system ranks 1st overall on our 2022 State Business Tax Climate Index. There are a total of 105 local tax jurisdictions across.

Individual Income Tax Rank. Wyoming also does not have a corporate income tax. Each year youll owe 50 to the State of Wyoming to keep your Wyoming company in good standing and 125 a year to us as your Wyoming Registered Agent.

Wyoming does not place a tax on retirement income. We recommend you form a Wyoming LLC or incorporate in Wyoming. Corporate tax rates by state 2021.

Cheyenne WY 82002-0110. Since january 1 2018 the nominal federal corporate tax rate in the united states of america is a flat 21 due to the passage of the tax cuts and jobs act of 2017. Wyoming C Corp Tax Rate.

Wyoming has no corporate income tax at the state level making it an attractive tax. Wyomingites have until June 6 to apply for a partial property tax refund for 2021. On profits of 10000 you would pay self-employment tax of 1530.

Currently six states Nevada Ohio South Dakota Texas Washington. This will cost you 325 for a corporation or an LLC. Wyoming Department of Revenue Website.

The maximum tax rate was 35. No Personal Income Taxes. Wyoming keeps going strong with another year at the top of the charts.

The tax is either 60 minimum or 0002 per dollar of business assets whichever is greater. Up to 25 cash back Corporate rates which most often are flat regardless of the amount of income generally range from roughly 4 to 10. Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also known as FICA Social Security or Medicare tax on your earnings.

Wyoming LLCs pay a 30 percent tax on all income from US.

2021 Corporate Tax Charges And Brackets Tax News Daily

Corporate Income Tax Definition Taxedu Tax Foundation

Corporate Taxes By State In 2022 Balancing Everything

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Corporate Tax Rates By State Where To Start A Business

2022 State Income Tax Rankings Tax Foundation

When Did Your State Adopt Its Corporate Income Tax Tax Foundation

State Corporate Taxes Improve The Tax Burden On Corporate Earnings Tax News Daily

Corporate Tax In The United States Wikiwand

Trump Tax Cuts Likely Make U S Corporate Tax Level Lowest Among Developed Countries Itep

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Corporate Income Tax Definition Taxedu Tax Foundation

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Corporate Tax In The United States Wikiwand

Corporate Tax Rates By State Where To Start A Business

Corporate Tax Reform In The Wake Of The Pandemic Itep

Corporate Income Tax Definition Taxedu Tax Foundation

How Do State And Local Corporate Income Taxes Work Tax Policy Center